After the hit taken by the global economy due to the COVID pandemic, hopes were high that 2022 would prove to be a return to something more like normality. That view took a heavy blow early in the year when Russia and Ukraine became embroiled in a major conflict. Sanctions imposed on Russia and difficulties in trading with Ukraine have reshaped some of the main global trade flows.

One of the main impacts on the global economy has been the massive rise in energy costs and the loss of a large proportion of European energy imports. Not surprisingly the rising energy costs have impacted economies around the globe and re-awakened the spectre of high inflation. Most of the western world is seeing inflation running at an average around 10%, a figure not seen for decades.

In its Review of Maritime Transport 2022, UNCTAD predicted that for the period 2023–2027 maritime trade growth would expand at an annual average of 2.1%, a slower rate than the previous three-decade average of 3.3%. In the report, Jan Hoffman, head of UNCTAD’s trade logistics branch, said “This is certainly worrying for shipowners.”

Mixed fortunes

However, the combination of trade flow changes and inflation is clearly hitting different sectors in different ways. The last year has seen a rapid decline in the fortunes of liner operators who had been enjoying record high freight rates through the previous two years. In 2023, the collective profits of major liner companies are expected to fall to $100bn from $275bn in 2022, according to shipping analyst Drewry.

In the LNG carrier sector, prospects have rarely looked as good. Demand was already rising before sanctions and the shutting down of pipelines from Russia. Around 300 LNG carriers are on order globally until 2028 with 165 ships slated for delivery over 2024-2025.

Russia has been able to keep crude production high exporting mostly to Asian countries and thus changing global trade routes. Despite sanctions on Russian products, there is likely to be more carriage of refined products from third party states towards Europe.

Bulk carriers have had mixed fortunes. Continued Covid related lockdowns in China have dampened need for raw materials and although much of China’s power is coal generated, demand has been able to be met internally. Limited grain shipments from Ukraine have also hit the sector.

BIMCO’s November report on the sector suggested newbuilding deliveries could hit a 19-year low in 2024. The report said the continued economic downturn will likely affect investment decisions and keep the orderbook small.

Surveys show fear of recession

According to two recent surveys, shipowners are pessimistic over the immediate future as 2023 opens. In its Outlook 2023 report, Lloyd’s List reports most of the experts it polled believe a global recession is inevitable. Close to 50% of respondents drawn from Lloyd’s List readers cited recession as the dominant risk affecting business prospects in 2023. Among other risks they named regulatory measures (including those of IMO towards zero emissions by 2050) and an oversupply of vessels. Other concerns include availability of new fuels (45.86%) and the cost of new fuels (26%).

When answering the question on which shipping sector will perform best in 2023, 40% of respondents named tanker, 27% - container, 14% - dry cargo. Over a half of the respondents (65%) believe that the small private shipowner will be an endangered species within the next decade.

“Shipping may revel in its apolitical status as the servants of the world economy, but global trade has always been — and will always be — highly politicised,” says Lloyd’s List Managing Editor Richard Meade.

Another report shows the fear of recession running even higher in the container sector. In the Container xChange’s LogTech 2023 predictions report, inflation and recession topped the list of fears with 88% of respondents noting them as factors for 2023, followed by implications of war with 57%, impact of COVID in China at 53% and worker strikes at 23%.

Shipping shines at COP27

Regardless of the uncertainties in trade flow changes, soaring costs, continuing geopolitical risks and growing tensions and more, the drive to decarbonise shipping is expected to continue. Indeed, the fact that major economies appear to have slowed or halted their decarbonisation drive has not yet filtered through to shipping although there was a noticeable hesitancy at IMO meetings in December 2022. At COP27 in Egypt in November 2022, there was much criticism of countries for perceived failings aside from a tentative agreement on the issues of loss and damage and some progress on establishing carbon markets.

The shipping industry by contrast was seen in a good light thanks in part to the Green Shipping Challenge organised by the US and Norwegian governments. The challenge was well supported by nations, ports, and shipping companies which were encouraged to prepare commitments to spur the transition to a greener shipping. Around 40 announcements on green corridors and other initiatives were made during the meeting, all of which can be seen at the Green Shipping Challenge website.

Shortly After COP27, the EU announced that from 2024 shipping will be included in the EU’s emission trading system (ETS). All ships above 5,000GT will be affected with 100% of emissions from intra EU voyages and 50% of emissions from voyages between EU ports and the rest of the world requiring to be covered. The system will be phased in beginning in 2024 with 40% of the costs due and rising to 70% in 2025 and 100% from 2026 onwards.

Based on the current $84 per tonne of carbon, the added cost to shipping will begin at around $120 per tonne of bunkers consumed for an intra-EU voyage in 2024 rising to almost $300 in 2026. Although generally expected by the industry, some concerns have been raised. Danish Shipping which represents operators based in Denmark were critical of the decision highlighting that the move will put short sea shipping in Europe at a competitive disadvantage with the road haulage sector which will only join the ETS at a much later date.

CII criticism intensifies

Although shipping bodies such as BIMCO and International Chamber of Shipping have been vocal supporters of decarbonising shipping albeit sometimes at odds with the IMO over the best course of action, there have been criticisms of the new measures coming into effect in 2023.

The Energy Efficiency Existing Ship Index (EEXI) for existing ships will see most ships being forced to slow down in future which, although saving some fuel consumption and consequent emissions, also puts ships in danger of not meeting the other new measure - the Carbon Intensity Index (CII). The CII has come in for criticism from across the industry; liner giants Maersk and MSC have both criticised CII, saying it “does not incentivise cargo optimisation”; Bulk carrier specialist Oldendorff issued a press statement in which it argued that “the shipping industry should not rely solely on the formulas in the regulation but needs to take a holistic view and focus on reduction of absolute emissions.” It also said, “focus on the CII rating letter grades will do more damage than good.”

MEPC making slow progress

Prior to the IMO MEPC 79 talks in December, the intersessional working group on greenhouse gases (ISWG-GHG13) produced a working document covering all proposals for the revision of the IMO GHG Reduction Strategy. The document was discussed at length during MEPC 79 where it was decided more work was needed, and the matter would be considered again at two more ISWG sessions and also at MEPC 80 in June 2023. Several proposals concerning EEXI and CII were also deferred until the June meeting.

There was discussion also on the various reduction measures for decarbonising shipping including technical and market-based measures. Whilst there was support and ambition from many of the delegates present to move to zero emissions by 2050 with potential intermediate targets at 2030 and 2040, it was unclear what any future strategy might include. On the matter of Energy Efficiency Design Index (EEDI) for newbuildings, amendments to the guidelines were agreed but there was no support for introducing a fourth phase at this moment in time.

The question of alternative fuels was also on the agenda particularly with regard to the question of avoiding promotion of fuels that may have a low tank to wake emission profile, but which have a high well to wake emissions. This was another matter which was to be the focus of further work.

Collaboration on environmental issues

On a more positive note, Industry initiatives and collaborations are underway to help operators and the industry on its decarbonisation journey. This spirit of co-operation was recognised in December 2022 when the Maersk Mc-Kinney Møller Centre for Zero Carbon Shipping published its latest Maritime Decarbonization Strategy report. The report also underlined that more action was needed.

Bo Cerup Simonsen, CEO of the Center said in the report, “We see the maritime private sector – energy companies, shipping companies, cargo owners – starting to mobilize and demonstrate climate leadership. However, despite the progressive initiatives, much more is needed. When we compare the scale of efforts and planned actions across the sector against the necessary timeline of the transformation, it is evident that we are still not doing enough to stay on the recommended track. Our sector needs more countries and companies to publicly articulate a decarbonization ambition, make plans, act accordingly and report on their progress.”

It has also been recognised that ports have an important role to play when it comes to decarbonization and some are leading the way like the Singapore’s PSA. Rotterdam is also pushing for greener operations.

Towards the end of 2022, The Lloyd’s Register Maritime Decarbonization Hub welcomed PSA to ‘The Silk Alliance’, a project aiming to develop a green corridor cluster beginning with intra-Asia container trade. PSA and the Port of Rotterdam have also linked up in a project that would see the establishment of the world’s largest green corridor. The two ports are the world’s top bunker ports and plan to meet the challenges stemming from the introduction of alternative fuels into the maritime fuel mix.

One factor that can help drive decarbonization in shipping is the provision of finance for new vessels. Leading shipping banks and finance houses have signed up to the Poseidon Principles. This is a global framework that increases the transparency of financial institutions’ shipping portfolios against IMO climate targets.

There is some progress, but it has been slower than hoped. In the third Poseidon Principles Annual Disclosure Report 2022 published in mid-December it was revealed that out of the more than two dozen international banks that have reported emissions data of their ship finance portfolios, only seven are aligned with the IMO’s current 2050 ambitions.

“This year’s reporting is the most granular and extensive yet, and more banks have joined the initiative, which is very encouraging,” said Michael Parker Chair of the Poseidon Principles. Parker says he is not discouraged that only a minority of reporting banks are aligned with the current 2050 target. “We are on a multi-year journey, but with this data we can see our performance, and support our decision-making with insight. Reducing GHG emissions has become a priority in the maritime industry, including for ship finance. However, ships have a 20+ year lifecycle. It will take time for this trend to be reflected in our portfolios, even with the banks favouring low-carbon projects,” he said.

Biofouling to the fore

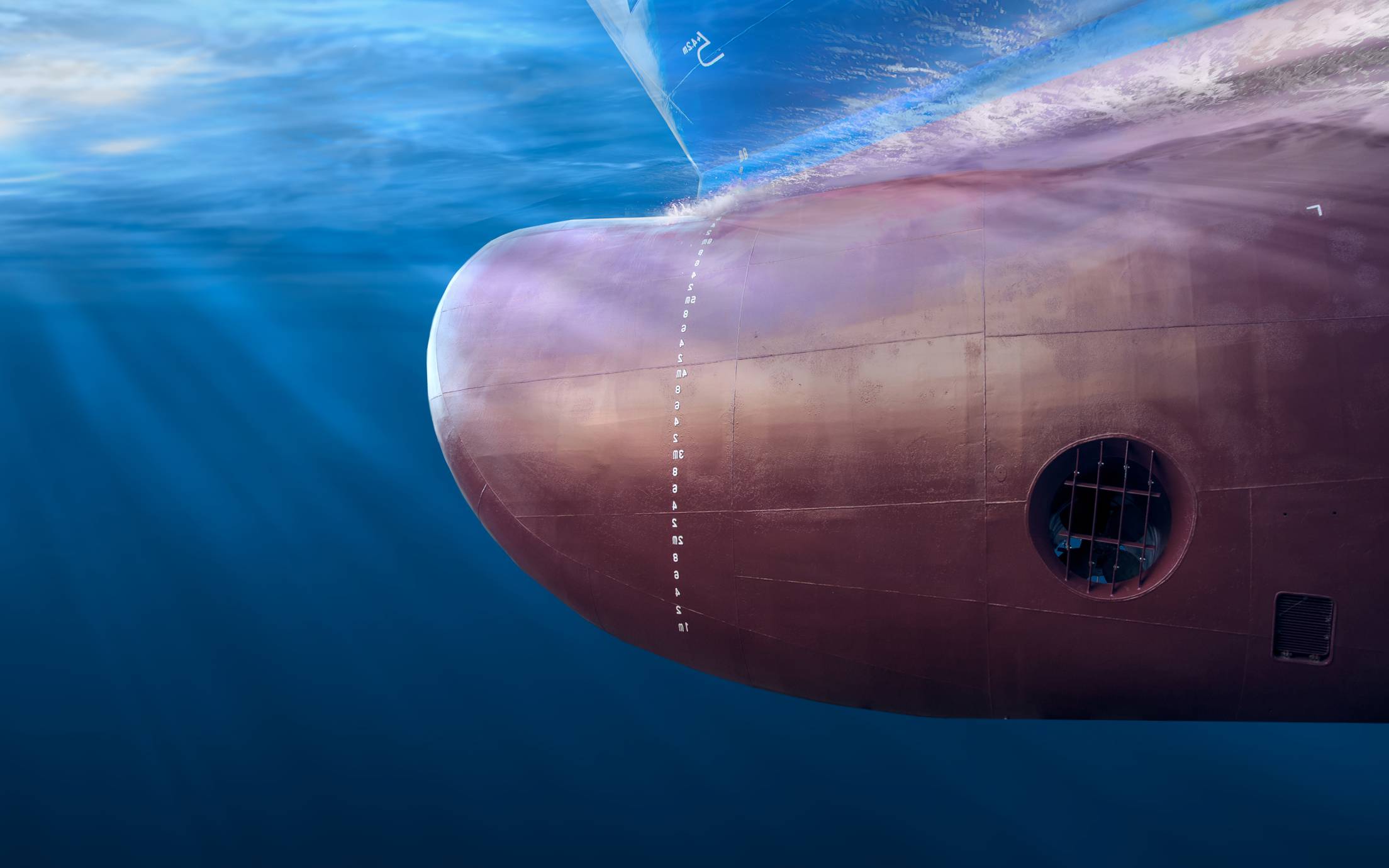

In the coatings and hull cleaning arena, The Global Industry Alliance (GIA) for marine biosafety is another example of collaboration. The organization is busy working with policy makers to shape biofouling strategies and regulations to help curb emissions and invasive species risks.

Biofouling has long been recognised as a problem within the maritime sector, but recent cases emphasise the adverse effect that it has on ship performance and that it gives rise to significant financial and environmental penalties for the shipping industry. Also, the biofouling issue has gained prominence as the IMO introduced its latest carbon indexing measures.

Overall, it is clear that the common consensus is the year ahead will be challenging, meaning ship operators need to be alert to the challenges and ready to take action. Soaring costs will make efficiency measures extremely important. EEXI and EEDI rules may be changing and attention may focus there but, for CII purposes, a clean hull and proactive hull cleaning offers considerable savings, in some cases up to double figures.

It is also interesting to see how industry stakeholders are collaborating on various other solutions such as standardized hull clean methods. Many argue alliances like the Clean Hull Initiative (CHI), which is working to develop an ISO standard for proactive cleaning, should be part of the biofouling management toolbox to help address both the increasing focus on biosecurity and ship efficiency.

One thing is certain and that is operators ready to exploit efficiency and environment improvements will see commercial benefits on multiple fronts, while attempting to profit from environmental degradation will almost certainly have a negative impact. Cleaner, more efficient technologies are already available and will improve the bottom line and the environment simultaneously.